Big Data Gives Insurers a Boost to Their Bottom Line

Published 6th Mar 2015Big data and analytics is fundamentally transforming business decision-making. From offering better insights into markets and opportunities, to building better bottom lines, big data is big news and the insurance industry isn’t immune to this shift.

However according to a PwC survey, among insurance executives 28% feel the quality, accuracy or completeness of the data they use in making big decisions isn’t high enough. And a recent EY Global Insurance CFO Survey found that 66% of financial and actuarial executives at insurance companies said they did not have access to the quality and granularity of data required to do their jobs most effectively.

Fortunately, sentiments like these no longer need to be echoed as we have adapted our Market Intelligence Platform so that insurance companies can access comprehensive economic analysis and insights into every household and business that comprise the American economy.

Previously insurers relied on proprietary information for their statistical and other analysis to improve the underwriting and pricing of policies. However this analysis had limits, as it only provided insight into the proportion of the population with which they had experience, leaving their analysis subject to the same shortcomings that plague sample- or survey-based decision models.

Now, by appending data from our rich dataset insurers can take their analysis well beyond the limits to which it was previously bound. They can gain highly accurate insights on market targets that were previously unavailable and access information that paints a better picture of the policyholder, giving a much needed edge to insurers looking to optimize risk and improve decision making.

Access to accurate and relevant data that provides context for making more informed business decisions is the key factor that insurance companies need to push their operations to the next level. We at Powerlytics are excited to partner with leading insurance organizations to make this much sought after tool a reality.

Read next

Published 26th Feb 2015

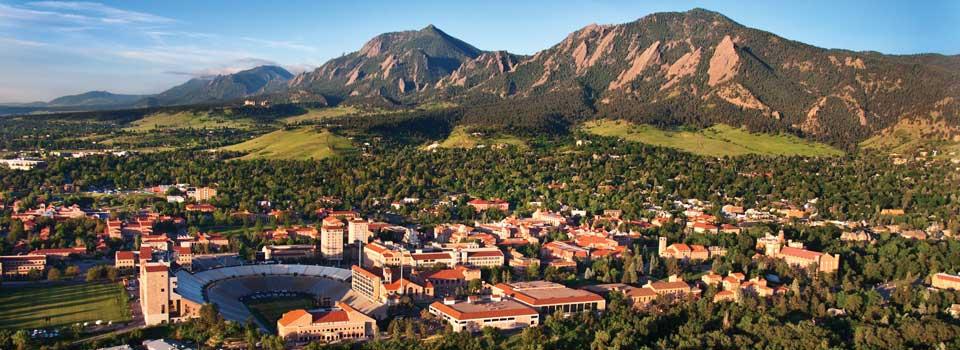

ArchivedBest Places to Live and Work in America

We’ve all seen them. Rankings of the best places to live, retire, start your career, raise your family and more. But, when you’re making one of the biggest decisions of your life,...

Read Article