Monit – Empowering Banks to Help Small Business Clients Grow

Published 25th Apr 2024Led by community bank veteran Steve Dow, Boston-based Monit is on a mission to help banks and credit unions serve their small and mid-sized business clients (SMBs) better. Monit has built a powerful technology platform that leverages SMB general ledger data to provide partner banks, credit unions and their SMB clients with the actionable insights and advice needed to help them grow while also positioning the financial institution as a trusted advisor. Since early 2022, Powerlytics business financial data has played a key role in Monit’s solution and we are excited to share a bit more about their story.

A Key Problem…Providing SMBs with Timely, Relevant Advice

Having spent many years as a community bank executive, Steve was very familiar with the financial challenges many business owners faced. Most small business owners were simply too busy to deeply analyze their own financials, and banks lacked access to the small business data and forecasts needed to deliver relevant insights and advice.

Enter Monit’s Small Business Insights Platform

From this challenge came the idea for Monit… an elegant technology platform for like-minded banks and credit unions coming together to unlock the power of their SMB clients’ data. Delivering on this simple but powerful idea could help many SMBs grow and succeed while positioning banks and credit unions to build deeper and stronger client relationships.

Beginning in 2019, Steve and his team worked to build out the robust and easy-to-use Monit platform while securing the bank and credit unions partnerships needed to enable their vision. All this work resulted in a realization of the initial vision as today dozens of leading banks leverage the Monit platform to provide insights and advice to their SMB clients.

How Does Monit Work

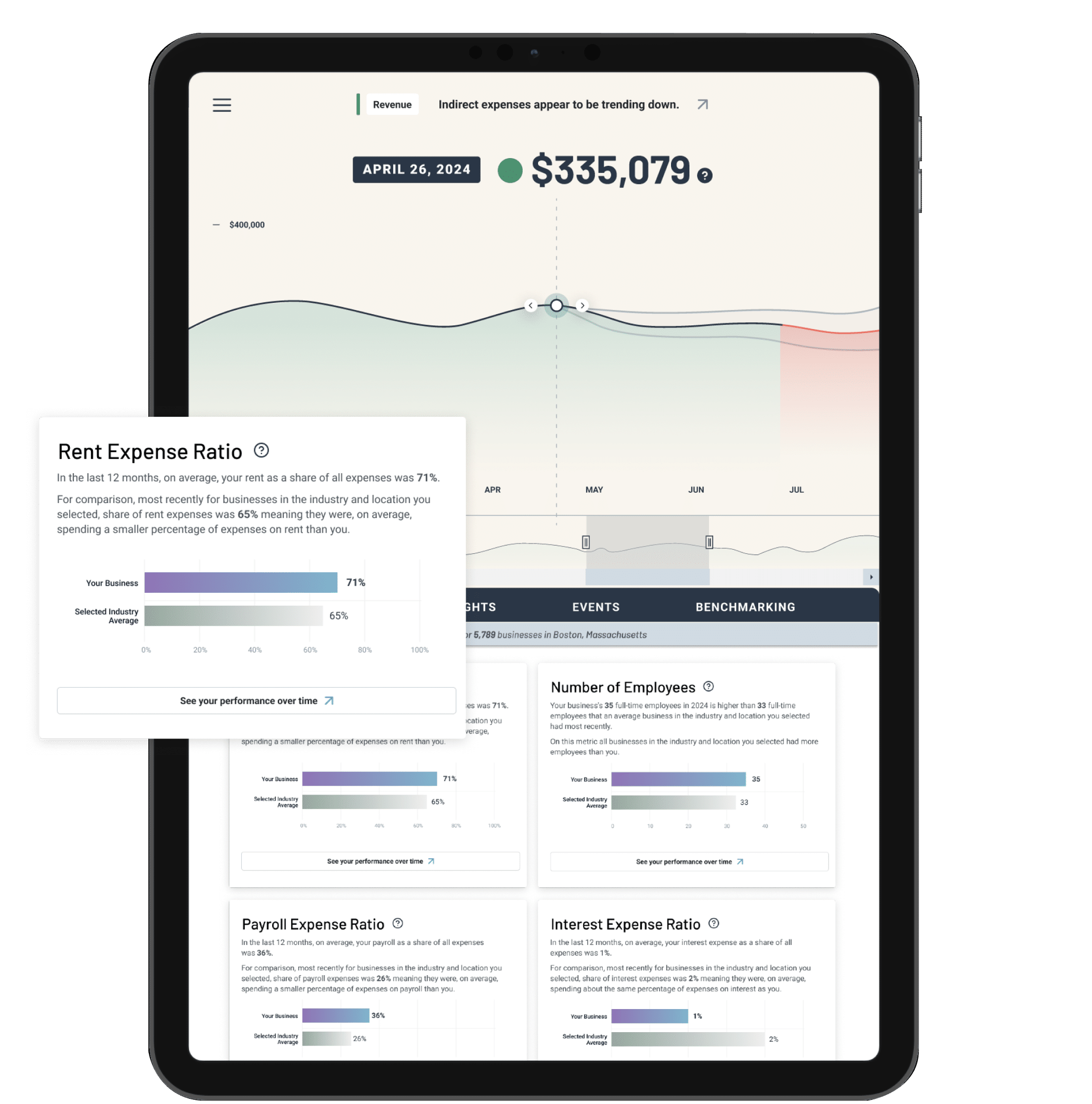

Monit partners with banks and credit unions who provide their SMB clients with the option of sharing secure, persistent real-time access to their general ledger data. When an SMB client provides ledger access, the data is captured into the Monit financial intelligence platform which uses analytics to in turn provide the SMB with powerful “digital CFO” tools such as cashflow forecasting, business valuation and industry benchmarking. The platform also provides banks and credit unions with tools and insights they can use to bring value to their clients. A few of the hundreds of possible insights include “uncovering excessive cash on hand relative to expenses” or “the depreciation schedule suggesting an upcoming new equipment purchase.” These and many other insights provide banks and credit unions with a powerful reason to reach out to their SMB clients to deliver insights, share advice and even suggest bank products or services that might meet the SMBs’ needs.

Powerlytics Business Data Help SMBs Benchmark Performance vs. Similar Businesses

In late 2021, Monit was introduced to financial data company Powerlytics and quickly saw a key opportunity to further enhance the insights delivered to SMBs. Underpinned by a database of anonymized tax returns, Powerlytics provides complete financial statement data on 33M+ US businesses. “We had been searching for a way to deliver business benchmarking and Powerlytics unique business dataset seemed liked the perfect solution,” said Monit CEO Steve Dow.

By marrying Powerlytics business financial statement data with Monit’s access to SMB general ledger data, Monit was now able to analyze an SMB’s industry and allow the business to instantly compare its metrics to those of similar businesses in its area. These insights help the business understand how it stacks up and identify areas for improvement. For example, a full-service restaurant with 12 employees in Boston ZIP Code 02108 can quickly understand where it stands vs. a small cohort of hyper-local similarly sized competitors on everything from cash management (i.e., by looking at Days Payable and Days Receivable) to expense control (by looking at Interest Expense and Payroll Expense) and much more.

Added Dow, “Powerlytics Business Benchmark Data has been a powerful value add for Monit. Our partner and small business owner feedback has been overwhelmingly positive, and we are excited to do even more with the Benchmark Data such as powering relevant and timely bank and credit union communications and marketing offers.”

Looking Forward

As Monit continues to add banks and credit unions, more SMBs will benefit from the unique insights enabled by the Monit platform and Powerlytics is excited to play a role helping deliver on this important mission!

Read next

Published 16th Apr 2024

News and EventsPowerlytics Data Helps Mortgage Lenders Understand Foreclosure Risk

With February home foreclosure activity up 8% vs. a year ago, understanding a borrower’s willingness and ability to stay current on their mortgage and out of default becomes even more critical for mortgage lenders.

Read Article